Pengaruh Etika, Sosialisasi, Dan Denda Pajak Terhadap Kepatuhan Wajib Pajak (Studi Empiris Di Kantor Pelayanan Pajak Pratama Surakarta)

Keywords:

Tax Ethics, Tax Socialization and Tax Penalty SanctionsAbstract

The purpose of this study was to obtain empirical evidence of the effect of tax ethics, tax

socialization, and tax penalties on taxpayer compliance. The population of this study is all Surakarta

City Individual Taxpayers, a total of 1,228 taxpayers, with the number of samples used is 250

respondent. Collecting data using primary data sources in the form of a questionnaire compiled

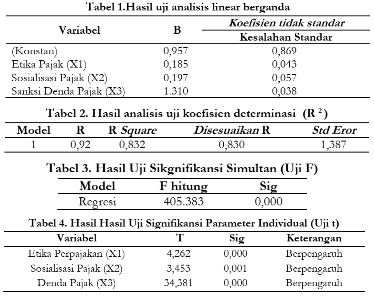

with a five-point Likers scale. The analytical method used is multiple linear analysis. Test the quality

of the data in this study using the R2 test, F test, and t test. the results of this study indicate that the

variables of tax ethics, tax socialization, and tax penalties have a positive effect on individual

taxpayer compliance.